Cinema is accustomed to a high degree of differentiation to home entertainment through technology. But this is rapidly changing. UHD for home includes 4K and the Rec 2020 color space, which is more inclusive than DCI P3 of Pointer’s gamut of real world reflected colors. Even home entertainment security is improving thanks to the efforts of Movie Labs, funded by the six major studios. In the US, the FCC fuels change through its Open Internet rules, also known as Net Neutrality, which commoditize the pathways for internet to the home, embracing the concept of 3rd party delivery of content over internet. With technology no longer in the way of fully experiencing movies in the home, the only barrier that remains standing is cinema’s exclusivity that defines the first release window. It’s no wonder that this is now under the microscope with proposals such as Sean Parker’s Screening Room to stream movies to home during the first release window for $50.

It will take more than technology equivalence, however, for in-home movie rental to succeed. By any account, Sean Parker’s Screening Room proposal has failed. Such proposals commoditize the first release window by offering a competitive alternative to brick-and-mortar cinema. When priced to compete, the result is not only cannibalization of theatrical attendance, but removal of the the shine that uniquely defines cinema.

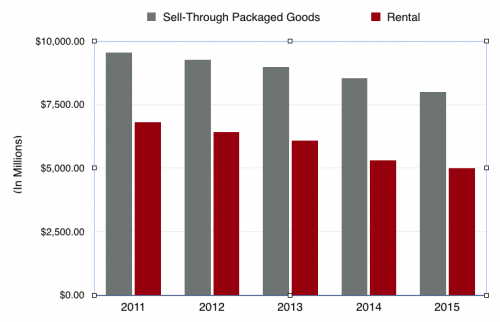

Home Entertainment Physical Media Sales and Rental

Technology is not the only motivator behind proposals such as Screening Room. Some studio executives see money in the simultaneous release of movies to home, offsetting the trend of falling high margin sales and rentals of physical media in home entertainment. Physical media revenues are falling at a pace of -5.5% per year, as illustrated in the chart above.

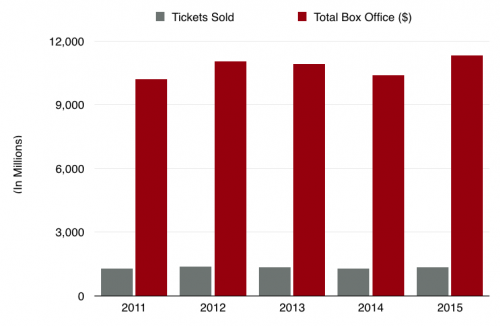

Theatrical Box Office

In contrast, US theatrical box office has remained relatively stable, as illustrated in the chart above. These two charts describe the tension that exists in studios towards the first release window. Many home entertainment divisions see money to be made, while theatrical execs aren’t willing to have their revenue stream cannibalized. It’s not a slam-dunk that studios want to bust open the first release window.

If home rental is to materialize, it will have to uphold the exclusivity of the cinema experience while generating revenue that is additive to overall box office, and not simply shuffle box office from cinema to home. Pricing is critical. A high price prevents commoditization of the experience. But maintaining a high price is not always in the interest of 3rd parties, who seek to maximize their own revenue by increasing volume. The best way to operate the service is as an industry-owned utility, given exclusive rights to distribute movies to home, and sharing revenue with all stakeholders in the first release window, i.e., both distributors and exhibitors.

This is the model first publicly described by Fred Rosen in his subtly titled article “Why Sean Parker’s Screening Room Plan to Home-Stream New Movies for $50 Is Absurd (Guest Blog),” published in The Wrap, an online publication. Mr. Rosen was the architect and CEO for 16 years of Ticketmaster, whose success in maximizing the value of live entertainment is legendary. His proposal for in-home movies follows suit: charge what the market will bear, and operate as an industry joint venture. At up to $700 per movie rental, his approach is not egalitarian, but neither will it commoditize cinema, which is what makes it so interesting.

When focused on high income customers, sensitivity for equipment pricing becomes unnecessary. Screening Room proposed receipt of movies using a $150 box that would connect to a home television, a strategy in line with the commoditization of renting movies in the home. But a $150 box is not likely to be as secure as an $8000 digital cinema media block. And if preserving the value of movies in the first release window, security is very important. Catering to high income consumers enables the price of the technology to be what it needs to be in order to be secure.

If there was a brand in cinema that promises to deliver a high end experience, it’s IMAX. Expanding on the train of thought proposed by Mr. Rosen, IMAX introduced “IMAX Private Theatre” this month, nicely described by Ars Technica in “IMAX will build you a home theatre—starting at £300,000.” IMAX takes the concept further and actually builds the home theater for its customers — a move that guarantees quality of experience. Price per movie rental is not discussed, but at $10,000 for the box that receives streamed content over internet, one can assume that the movie rental fee isn’t $50.

Where IMAX is willing to keep its in-home rental installation count limited, Mr. Rosen, in conversation, describes his vision to seek a larger footprint. By approaching the equipment from the point-of-view of technology equivalency, it should be possible to construct the business model so that equipment cost isn’t the gating factor.

Technology equivalency is opening the door to in-home rental of movies, with technology no longer the barrier to entry. Not unexpectedly, the business model will be the determining factor. A presentation from MKPE that discusses many of the factors that go into a business model, titled Considerations for In-Home Movie Rental. If exhibitors wish to preserve their brick-and-mortar businesses now and into the future, it’s best to get in front of the discussion for movies-to-home.